Debt Investors

Long Term Objectives

Commitment to investment grade credit ratings

Diversify source where pricing is favourable

Maintain access to diverse debt capital markets

Extend average tenor of debt and maintain good maturity spread profile

Credit Rating

Current Credit Rating

Aurizon Operations Limited

| ISSUER CREDIT RATING | |

|---|---|

| S&P (Outlook) | BBB+ (Stable) |

| Moody's (Outlook) | Baa1 (Stable) |

Aurizon Network Pty Ltd

| ISSUER CREDIT RATING | |

|---|---|

| S&P (Outlook) | BBB+ (Stable) |

| Moody's (Outlook) | Baa1 (Stable) |

Historical Credit Rating

Aurizon Holdings Limited*

| FY19 | FY18 | FY17 | FY16 | FY15 | FY14 | FY13 | FY12 | FY11 | |

|---|---|---|---|---|---|---|---|---|---|

| S&P (Outlook) | BBB+ (Stable) | BBB+ (Stable) |

BBB+ (Stable) |

BBB+ (Stable) | BBB+ (Stable) | BBB+ (Stable) |

BBB+ (Stable) |

BBB+ (Stable) |

BBB+ (Stable) |

| Moody's (Outlook) | Baa1 (Stable) | Baa1 (Stable) |

Baa1 (Stable) |

Baa1 (negative) | Baa1 (Stable) | Baa1 (Stable) | Baa1 (Stable) |

Baa1 (Stable) |

Baa1 (Stable) |

* Ratings withdrawn September 2019.

Aurizon Network Pty Ltd

| FY23 | FY22 | FY21 | FY20 | FY19 | FY18 | FY17 | FY16 | FY15 | FY14 | FY13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| S&P (Outlook) | BBB+ (Stable) | BBB+ (Stable) | BBB+ (Stable) | BBB+ (Stable) |

BBB+ (Stable) | BBB+ (Stable) |

BBB+ (Stable) |

BBB+ (Stable) | BBB+ (Stable) |

BBB+ (Stable) |

BBB+ (Stable) |

| Moody's (Outlook) |

Baa1 (Stable) | Baa1 (Stable) | Baa1 (Stable) | Baa1 (Stable) |

Baa1 (Stable) | Baa1 (Stable) |

Baa1 (Stable) |

Baa1 (negative) | Baa1 (Stable) |

Baa1 (Stable) |

Baa1 (Stable) |

Aurizon Operations Limited

| FY23 | FY22 | FY21 | FY20 | |

|---|---|---|---|---|

| S&P (Outlook) | BBB+ (Stable) | BBB+ (Stable) | BBB+ (Stable) | BBB+ (Stable) |

| Moody's (Outlook) |

Baa1 (Stable) | Baa1 (Stable) | Baa1 (Stable) | Baa1 (Stable) |

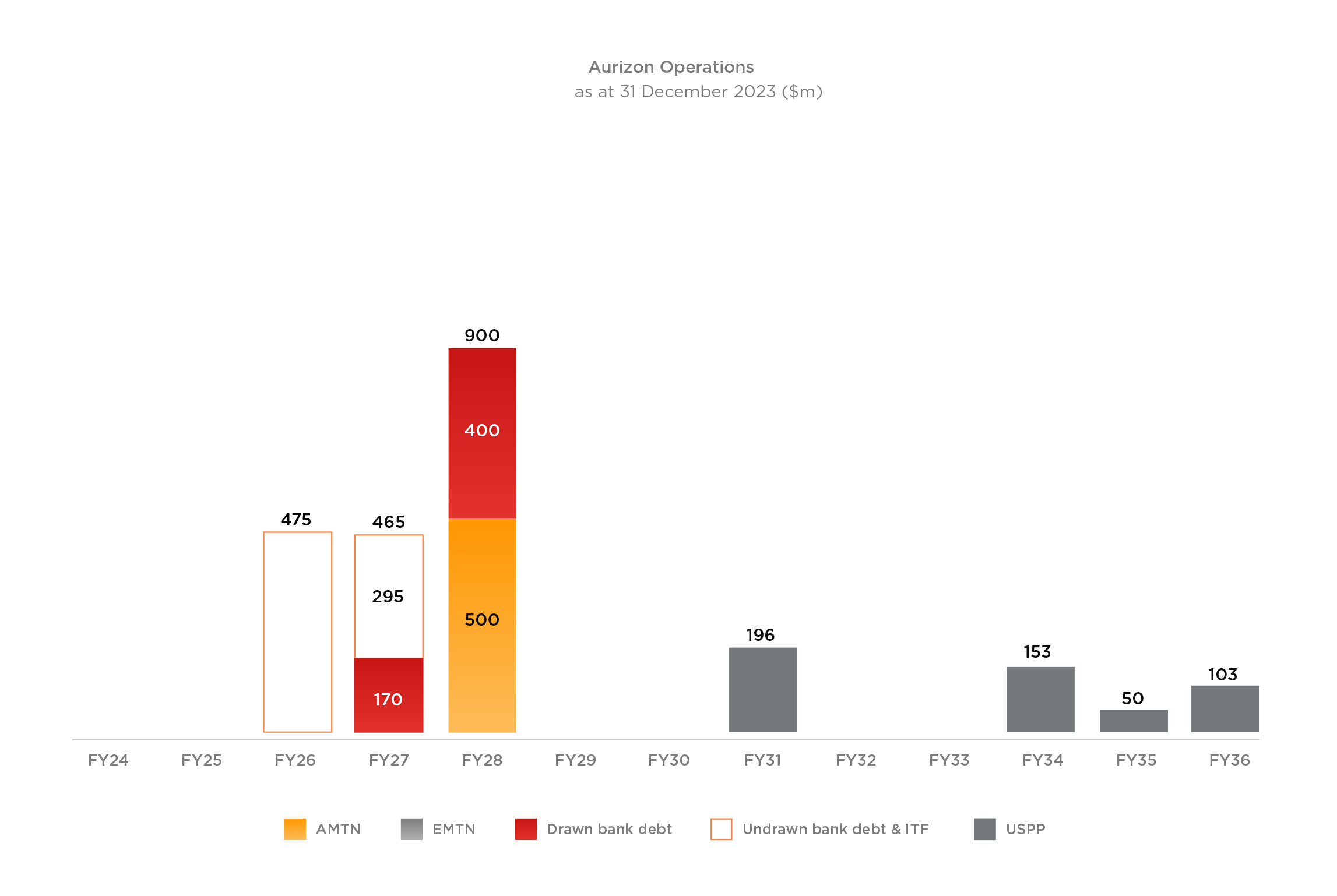

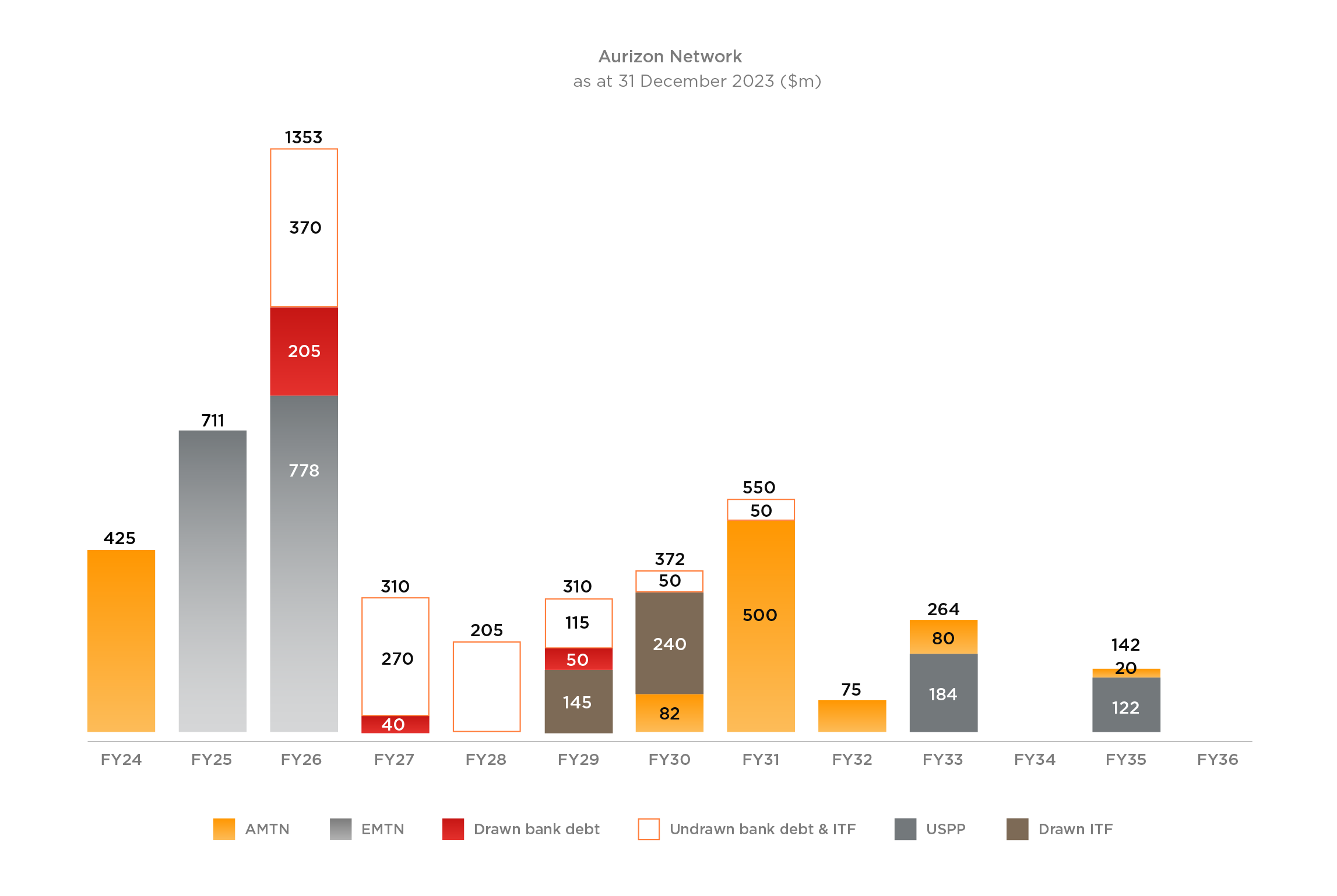

Debt Maturity Profile

*Balances reflective of drawn debt, excluding working capital facility.

*Abbreviations: Australian Medium Term Note (AMTN), Euro Medium Term Note (EMTN), United States Private Placement (USPP), Institutional Term Facility (ITF)

Borrowings

Bank Loans

Aurizon Finance has bilateral bank debt facilities totalling $A540m and syndicated bank debt facilities totalling $800 million. Aurizon Network has bilateral bank debt facilities totalling $A1.24 billion.

Institutional Term Facilities

In December 2023, Aurizon Network established an Institutional Term Facility across 5 and 6 year tranches, totalling A$260m and A$240m, and maturing in December 2028 and December 2029 respectively.

Australia Dollar Corporate Bonds

In June 2017, Aurizon Network priced a 7 year Medium Term Note (“MTN”) with a face value of A$425 million, maturing on 21 June 2024. The bond was issued at a fixed rate with a semi-annual coupon of 4.00 per cent per annum.

In September 2019, Aurizon Network issued a 10.5 year A$ Private Placement with a face value of $82 million, maturing on 22 March 2030. The bond was issued at a fixed rate with a semi-annual coupon of 2.885 per cent per annum.

In August 2020, Aurizon Network priced a 10 year Medium Term Note (“MTN”) with a face value of A$500 million, maturing on 2 September 2030. The bond was issued at a fixed rate with a semi-annual coupon of 2.90 per cent per annum.

In March 2021, Aurizon Finance (Operations) priced a 7 year Medium Term Note (“MTN”) with a face value of A$500 million, maturing on 9 March 2028. The bond was issued at a fixed rate with a semi-annual coupon of 3.00 per cent per annum. The issuance represented Aurizon Finance’s (Operations’) debut issue in the A$ bond market.

In June 2021, Aurizon Network issued a 10.5 year A$ Private Placement with a face value of A$75 million, maturing on 15 December 2031. The bond was issued at a fixed rate with a semi-annual coupon of 3.291 per cent per annum.

In December 2022, Aurizon Network issued 10 year and 12 year A$ Private Placements with a face value of A$50 and A$20 million respectively, maturing on 21 December 2034. The 10 year bond was issued at a fixed rate with a semi-annual coupon of 6.39 per cent per annum and the 12 year bond was issued at a fixed rate with a semi-annual coupon of 6.56 per cent per annum. In February 2023, a further A$30m face value of the 10 year line occurred via a ‘tap’, increasing the total outstanding to A$80m.

Euro Corporate Bonds

In September 2014 Aurizon Network priced a 10 year Euro Medium Term Note ("EMTN") with a face value of €500 million, maturing on September 2024. The bond was issued with a coupon of 2.001 per cent per annum. The issuance represented Aurizon Network’s debut issue in the Euro bond market.

In May 2016 Aurizon Network priced a 10 year Euro Medium Term Note (“EMTN”) with a face value of €500 million, maturing on 1 June 2026. The bond was issued with a coupon of 3.1251 per cent per annum.

United States Private Placement Notes

In April 2023, Aurizon Network priced the following series of United Statements Private Placement (“USPP”) notes across USD and AUD denominations:

- 10 year A$55 million face value with a semi-annual fixed rate of 7.552 per cent per annum, maturing on 28 June 2033

- 12 year A$55 million face value with a semi-annual fixed rate of 7.762 per cent per annum, maturing on 28 June 2035

- 10 year US$87 million face value with a semi-annual fixed rate of 6.53 per cent per annum, maturing on 28 June 2033

- 12 year US$45 million face value with a semi-annual fixed rate of 6.63 per cent per annum, maturing on 28 June 2035

This issuance represented Aurizon Network’s debut issue in the USPP market.

In June 2023, Aurizon Finance (Operations) priced the following series of USPP notes across USD and AUD denominations:

- 10 year A$50 million face value with a semi-annual fixed rate of 7.82 per cent per annum, maturing on 26 July 2033

- 11 year A$50 million face value with a quarterly rate of 3.63 per cent over the bank bill swap rate, maturing on 26 July 2034

- 7 year US$133 million face value with a semi-annual fixed rate of 6.752 per cent per annum, maturing on 26 July 2030

- 10 year US$70 million face value with a semi-annual fixed rate of 6.782 per cent per annum, maturing on 26 July 2033

- 12 year US$70 million face value with a semi-annual fixed rate of 6.882 per cent per annum, maturing on 26 July 2035

Other Bank Loans - Working Capital Agreement

Aurizon Finance and Aurizon Network have bilateral working capital facility agreements for A$125m and A$75m respectively. These facilities are reviewed on an annual basis.

1. Fixed rate based on a Euro coupon

2. Fixed rate based on a USD coupon

Documents & Links

Domestic Debt Capital Markets

-

Aurizon Operations Debt Investor Presentation - February 20211.0MB PDF

-

Aurizon Finance A$MTN Programme Information Memorandum - 17 February 2021639KB PDF

-

FY20 Debt Investor Presentation4.0MB PDF

-

AMTN Investor Update2.0MB PDF

-

FY19 Debt Investors Presentation2.0MB PDF

-

FY18 Debt Investor Update2.0MB PDF

-

HY19 Debt Investor Update1.0MB PDF

-

HY18 Debt Investor Update1.0MB PDF

-

FY17 Debt Investor Update1.0MB PDF

-

AMTN Roadshow Presentation - June 20172.0MB PDF

-

HY17 Debt Investor Update1.0MB PDF

-

FY16 Debt Investor Update454KB PDF

-

HY16 Debt Investor Update1.0MB PDF

-

FY15 Debt Investor Update1.0MB PDF

-

A$MTN Roadshow Presentation – October 2013917KB PDF

-

A$MTN Programme Information Memorandum – 4 October 2013339KB PDF

-

FY14 Debt Investor Update985KB PDF

Offshore Debt Capital Markets

-

HY19 Debt Investor Update1.0MB PDF

-

HY17 EMTN Debt Investor Update2.0MB PDF

-

Aurizon Debt Investor Roadshow - December 20162.0MB PDF

-

EMTN Roadshow Presentation – May 20166.0MB PDF

-

EMTN Offering Circular – May 2016703KB PDF

-

HY16 EMTN Debt Investor Update2.0MB PDF

-

EMTN Roadshow Presentation643KB PDF

-

EMTN Offering Circular – September 2014774KB PDF

Financial Reports

Contact us

Phone: 13 23 32

Or contact us online:

Get the latest investor news delivered direct to your inbox Sign up for investor alerts